- The Edge

- Posts

- Next Edge

Next Edge

Welcome to the January 2026 edition of The Edge! Lots of optimism for housing!

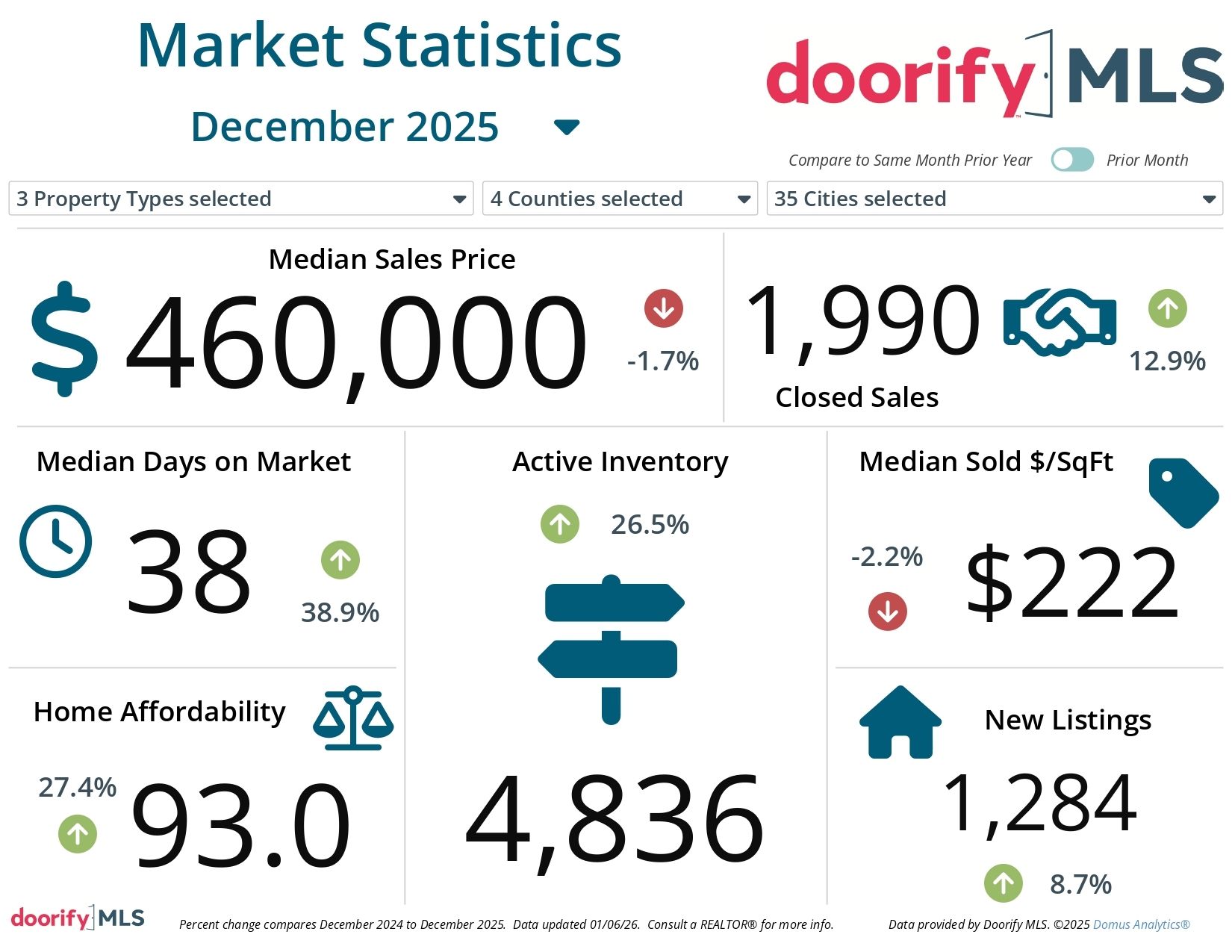

DECEMBER STATS

🏡 Market Snapshot

Market Stats: Prices continue to soften down in December YoY 1.7% and the median price was 488K in July and closed the year at 460K that is almost a 6% decline. Lower prices and seller incentives spurred sales in December. Up 20% MoM and 13% YoY.

Buyers: If you are a buyer: Be more aggressive with your offer, ask for closing costs, keep your Due Diligence lower, ask for rate buy downs or concession to pay for your buyers agent. Look to New Construction. Builders offer great incentives especially this time of year including rate buy downs! They are also willing to take “contingency on sale”. Move quickly in the new year as this market could change quickly if rates move under 6%.

Sellers: If you are a seller: Depending on your personal situation it may be best to wait until late Q1 of 2026 to sell your home. Homes in top condition, in popular locations are still moving quickly.

Please note: The answer to all real estate questions are “it depends”. Homes, locations, zip codes, subdivisions and most importantly, your goals all play a part in real estate advice. Above is guide to what we are seeing in the overall market.

REAL ESTATE

2026 Real Estate Predictions

🔮2026 Real Estate Forecast: Cautious Optimism with a Few Wildcards

As we kick off 2026, the housing market appears poised for gradual normalization after several years of elevated mortgage rates, tight inventory, and affordability headaches. Most major housing economists are calling next year a year of improvement rather than boom, where buyers finally get some breathing room, though challenges remain.

1) Mortgage Rates — Averaging ~5.75%

While Redfin, NAR, Realtor.com, and others forecast mortgage rates averaging in the low-6% range, there’s reason to believe 2026 could lean a bit lower — especially if inflation continues to ease and the Federal Reserve holds policy steady or cuts modestly.

Redfin expects the average 30-year fixed rate to hover around ≈6.3% next year.

NAR projects rates averaging near 6%, assuming modest Federal Reserve easing.

Realtor.com also sees low-6% rates supporting affordability gains.

Our forecast of ~5.75% sits just below most mainstream projections — and if rates do dip into the high 5s during the year, it could be a meaningful tailwind for buyers early in 2026.

2) Home Sales — Expect a Strong Bounce

Sales activity — which has been sluggish in recent years — should pick up noticeably as rates moderate and affordability improves.

NAR is forecasting roughly a 14% increase in existing-home sales next year, driven by rate relief, job gains, and more inventory.

Redfin expects sales to rise more modestly, around 3% year-over-year, as affordability remains a headwind for many buyers.

Other economists (e.g., MBA, Zillow) also foresee sales growing as more buyers re-enter the market once financing becomes less prohibitive.

Our predictions of a 10% increase in sales is well within the range of current forecasts — more aggressive than Redfin’s but more conservative than NAR’s, reflecting a balanced view of both demand and affordability constraints.

3) Wildcard: Government Policy — 50-Year Mortgages & Mortgage Portability

One of the biggest wildcards for 2026 is potential government intervention aimed at expanding access and easing monthly costs.

50-Year Mortgages:

There’s occasional buzz about extending mortgage terms beyond the traditional 30 years — for example, a 40- or 50-year fixed mortgage. In theory, lengthening the loan term reduces monthly payments because the same principal is spread over more years. But there’s a big catch: borrowers build equity much more slowly, and lenders may charge higher rates or stricter underwriting standards to compensate for the extended duration.

Mortgage Portability:

Mortgage portability refers to a borrower’s ability to take their existing mortgage rate with them when they sell their home and buy another. This concept has huge appeal in a high-rate environment:

Homeowners locked into low-rate mortgages (e.g., 3–4%) often stay put rather than move because they would have to give up their cheap rate and take on a new higher-rate loan.

Portability could reduce this disincentive, improving market liquidity and boosting move-up and trade-up transactions.

If implemented broadly, mortgage portability could unlock inventory and reduce the “rate lock-in effect” that has weighed on sales for years.

At present, portability remains a policy discussion rather than an industry norm, so we’ll be watching this space closely as 2026 unfolds.

HOT MARKET

Why Chatham County is One of North Carolina’s Hottest Real Estate Markets

Chatham County has quickly become one of the most talked-about housing markets in North Carolina — and for good reason. What was once a quieter, rural corner of the Triangle has transformed into a highly desirable location for both in-state buyers and those relocating from high-cost metros. A mix of lifestyle appeal, limited inventory, and strong demand has pushed Chatham into a league of its own when it comes to real estate activity

Strong Price Points Reflect High Demand

Across the county, home prices have climbed into ranges that outpace many nearby markets. Recent data places median home values well above traditional North Carolina medians — with some reports showing typical listing and sale prices reaching into the $700,000 range or higher.

While annual appreciation has moderated from the double-digit increases seen earlier in the decade, prices remain elevated compared to neighboring counties, reflecting sustained buyer interest and limited supply.

Land: A Key Differentiator

One of the defining features of Chatham’s market is its abundance of rural land paired with strong development interest. Buyers and developers alike are attracted to larger parcels — with median land prices per acre rising as demand grows. Because many properties remain outside dense municipal sewer systems, lots tend to be larger, more private, and more expensive than in urban areas — a factor that both fuels demand and drives price growth.

This emphasis on space draws people seeking acreage, privacy, and a more relaxed lifestyle while staying within reach of job centers in the Triangle.

New Construction Drives Market Activity

New home building in Chatham County remains a noteworthy trend. Builders are actively developing a mix of product types, from mid-priced homes starting in the $400Ks to high-end estates above $1 million. Most new construction sites feature generous lot sizes and modern floor plans, appealing to families and relocators looking for room to grow. Because a large share of the county’s housing stock is new or recently built, this fresh inventory helps maintain buyer interest even when resale options are limited.

Looking Ahead

The combined effect of strong pricing, land demand, and ongoing construction has positioned Chatham County as one of the Triangle’s hottest real estate markets. For buyers and sellers alike, understanding these dynamics is key to navigating one of North Carolina’s most dynamic housing landscapes.

TRIVIA

Which home feature is most likely to make buyers fall in love during a showing?

A) A freshly painted garage

B) A bright, open kitchen

C) Extra storage closets

D) A perfectly mowed lawn

REAL ESTATE

A Smarter Way to Search for Homes in North Carolina

Most buyers start their home search online — but not all home search tools are created equal. One of the biggest mistakes I see is people relying on generic national sites that don’t always show the full picture or allow you to truly dial in what you want. That’s exactly why I built a more powerful, local home search experience on my website.

On ExploreNorthCarolinaHomes.com, you can search every home for sale across the Triangle and surrounding counties, including Chatham, Wake, Durham, Orange, and beyond. The search pulls directly from the MLS, which means you’re seeing the most accurate pricing, status updates, and new listings — often faster than you’ll find them elsewhere.

What really sets it apart is the ability to customize your search. You can filter by price, location, lot size, schools, new construction, and even very specific criteria like acreage or property type. Once your search is set up, you can save it and receive alerts so you’re notified the moment a home that fits your criteria hits the market. No refreshing pages, no missing opportunities.

I recently recorded a 6-minute video tutorial walking through exactly how to set up a search on the site, along with some tips and tricks I use myself to help buyers narrow in on the right homes faster. Whether you’re just starting to look or casually watching the market, this is a great way to stay informed without feeling overwhelmed.

If you’re curious about what’s available right now — or want to explore what your budget looks like in different areas — I encourage you to try the search for yourself. It’s simple, powerful, and designed to make your home search easier and more informed from day one.

ANSWER

Answer: B) A bright, open kitchen

Reply